How Clients Can Whittle Down Medicare’s IRMAA

Clients nearing Medicare age should know about IRMAA (Income-Related Monthly Adjusted Amount), inflation-adjusted surcharges on parts B and D of Medicare. IRMAA surcharges—which first appeared in 2007 as part of the Medicare Prescription Drug, Improvement, and Modernization Act of 2003—kick in for 2024 when clients hit just $103,000 of […]

Clients nearing Medicare age should know about IRMAA (Income-Related Monthly Adjusted Amount), inflation-adjusted surcharges on parts B and D of Medicare.

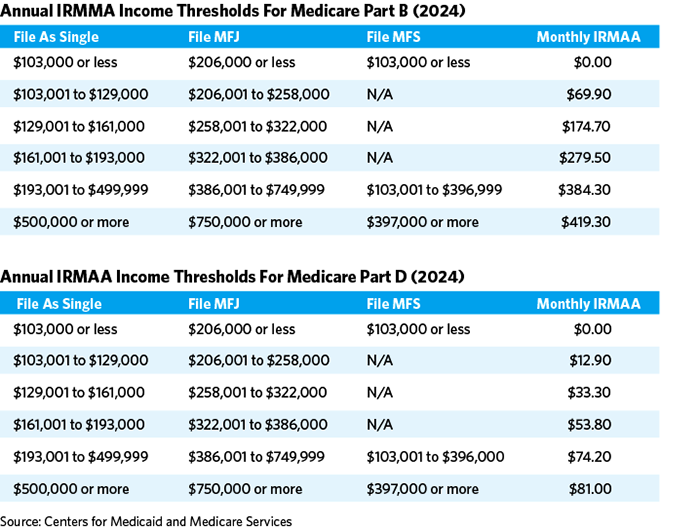

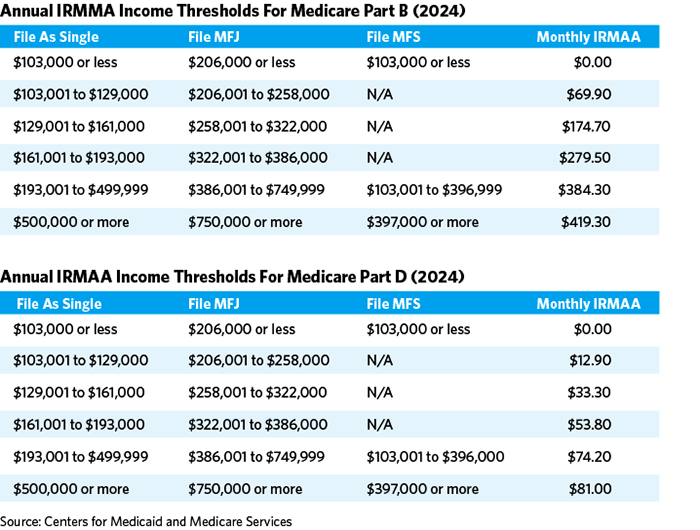

IRMAA surcharges—which first appeared in 2007 as part of the Medicare Prescription Drug, Improvement, and Modernization Act of 2003—kick in for 2024 when clients hit just $103,000 of annual modified adjusted gross income (MAGI) for single taxpayers and $206,000 for married couples filing jointly, based on their tax returns from two years prior. IRMAA rates are determined by tax return information from two years prior because many taxpayers file on the extended deadline in October, which gives the federal government insufficient time to set premiums if relying on just the previous year’s tax information.

“Because we have a marginal income tax rate, if you’re bumped into the next higher tax bracket only your dollars of income over the limit are taxed at the higher rate,” said Jennifer Storey, principal at Homrich Berg in Atlanta. “IRMAA brackets are a ‘cliff.’ Make one dollar over the bracket threshold, you and your spouse (if you’re married filing jointly and both enrolled in Medicare) will pay that bracket’s IRMAA.”

“People on Medicare who have MAGI between the tax brackets of $206,000 to $750,000 need to plan to try and keep their MAGI lower than the next upward bracket,” said Daniel F. Rahill, wealth strategist with Wintrust Wealth Management in Chicago, who in his second year of paying IRMAA.

For this year, a client who’s a Medicare recipient with MAGI of $193,000 and who files taxes under single status will pay a Part B monthly IRMAA of $279.50. If their MAGI is just a dollar more, that same client will pay a monthly IRMAA of $384.30.

“The adjusted gross income on the 2022 tax return determines the additional Medicare premiums that a Medicare beneficiary must pay every month during 2024,” said Mary Kay Foss, a CPA in Carlsbad, Calif.

“Once IRS receives the 2022 federal income tax return, they provide to Social Security Administration the amount of adjusted gross income and the amount of tax-exempt income reported,” Foss said. “If the 2022 return was filed in October 2023, Social Security will send the beneficiary a letter reciting the information from IRS, adding the two figures together to get MAGI. ... The additional Medicare Part B and Part D amounts will reduce the January Social Security payment.

“Unfortunately,” Foss added, “many affected clients find out [only when] their Social Security payments are reduced by IRMAA.”

“IRMAA determinations are recalculated every year, so it’s possible for IRMAA surcharges to drop off in a given year if the income decreases enough from one year to the next,” said Gina P. Slayton, wealth advisor with Bartlett Wealth Management in Cincinnati.

“If clients know that their income will be significantly lower going forward compared to years past ... they can file for a redetermination with Form SSA-44,” Slayton said. “If a client or their spouse qualify for a life-changing event and had a reduction of income, they should file an appeal on the IRMAA determination. A few of the most common qualifying life-changing events are retirement, work reduction, death of a spouse, and divorce.”

“Many items that you’d think would allow for a redetermination don’t meet SSA criteria,” Foss said, such as a large capital gain for the sale of a home even if the money was immediately invested in another home.

Controlling income is key to controlling IRMAA, using such tactics as qualified charitable distributions from IRAs for those over age 70½, charitable bunching and tax-loss harvesting, advisors said.

Rahill suggested limiting income triggers like Roth conversions or deferring income. The latter could mean postponing taxable Social Security benefits, not exercising stock options or delaying sales of assets. He also recommended managing losses or expenses with deductible expenses (for clients who file a Schedule C) and by increasing IRA or other benefit plan contributions.

Rahill suggests working with a Medicare plan consultant, helpful in running different Medicare plans and IRMAA scenarios.

“As clients approach Medicare age, we make it a point to [make them] as tax aware as possible when it comes to investment income, capital gains and variable income sources,” Storey said, as tax planning “serves double duty when it comes to Medicare and IRMAA.”

Click here to view full article